Beyond using high-quality goods or services, business owners must have a clear understanding of their financial performance in order to run a successful company. One of the most powerful tools for this is the Profit and Loss Statement (P&L Statement).

The Profit and Loss Statement enables business owners to track revenue, expenses, and profit or loss, giving them an accurate picture of where their money is coming from and where it is going. Knowing your financial performance ultimately enables you to make informed decisions, improve profits, and stay ahead of financial challenges.

Let’s simplify the process and break down the specifics.

What Is a Profit and Loss Statement?

A business’s income and expenses for a given time period (monthly, quarterly, or annually) are summarized in a profit and loss statement.

A P&L Statement answers three key questions:

- How much total sales revenue did the business generate?

- How much total money did the business spend?

- What was the total profit (or loss)?

The Importance of a Profit and Loss Statement

Profit and Loss Statements help business owners:

- Understand how profitable their company is

- Identify rising costs and how those costs impact profit

- Track performance month-to-month or over longer periods

- Improve budgeting and forecasting

- Make smarter financial decisions

- Attract investors or secure loans

- Meet regulatory financial reporting requirements

Accurate P&L statements make it far easier to identify what is working and what is not.

Key Sections of a Profit and Loss Statement

Here is a clean, step-by-step breakdown of the main components:

1. Revenue / Sales

The total revenue earned from selling goods or services before any deductions.

2. Cost of Goods Sold (COGS)

These are the costs directly associated with producing goods or delivering services.

Examples include:

- Raw materials

- Packaging

- Direct labor

- Production

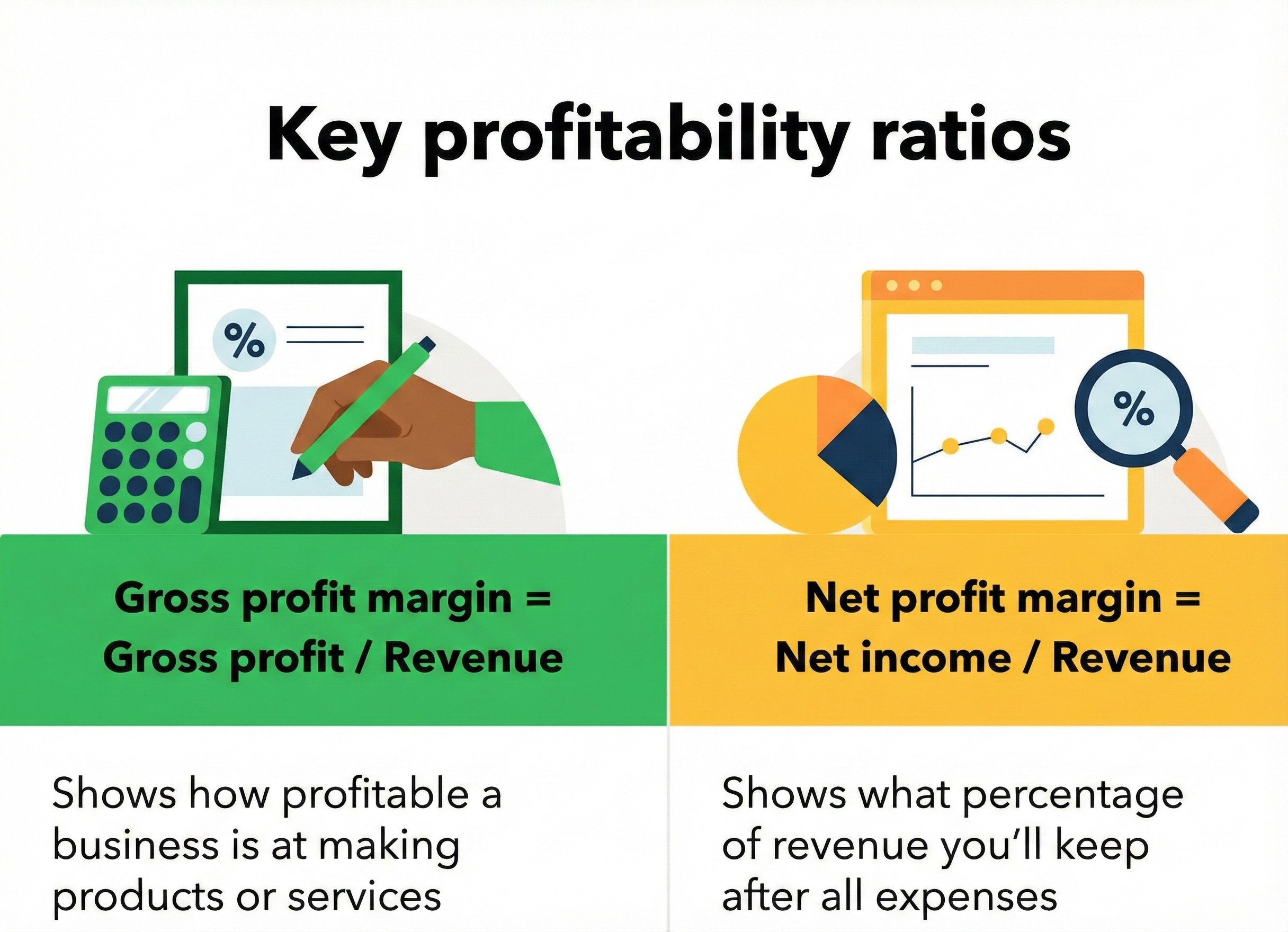

Gross Profit = Revenue – COGS

3. Operating Expenses (OPEX)

Recurring expenses required to maintain daily operations.

Common examples:

• Rent

• Salaries

• Utilities

• Software and tools

• Marketing

• Office supplies

4. Income from Operations

Income from Operations represents:

Gross Profit – Operating Expenses

This shows how much the business earned from its core operations.

5. Income and Expenses Not From Operations

These are non-operational items such as:

• Interest earned

• Interest paid

• One-time gains or losses

• Tax adjustments

6. Net Profit (or Loss)

The bottom line of the P&L.

- If this value is greater than 0, the company made money.

- If this value is less than 0, the company lost money.

Benefits of Using a P&L Statement Regularly

✔ Better Financial Control

You always know where money is going, minimizing waste and maximizing spending efficiency.

✔ Better Business Decisions

Clear visibility helps with decisions such as:

• When to hire

• When to scale

• When to cut expenses

• Where to invest more

✔ Better Cash Flow Management

P&L insights highlight late-paying customers, rising costs, and seasonal dips.

✔ More Accurate Forecasting

Historical P&L trends make it easy to plan for future revenue, expenses, and growth.

✔ Increased Investor Confidence

Banks and investors usually require P&L statements before approving loans or funding.

Frequent Errors Made by Business Owners

To avoid inaccurate P&L statements, business owners should be careful with the following mistakes:

- Combining personal and business expenses

- Forgetting to categorize expenses properly

- Ignoring small but recurring expenses

- Relying on manual spreadsheet data entry

- Waiting until year-end to prepare financials

These mistakes often lead to misreported financial positions, poor decisions, and difficulty securing funding.

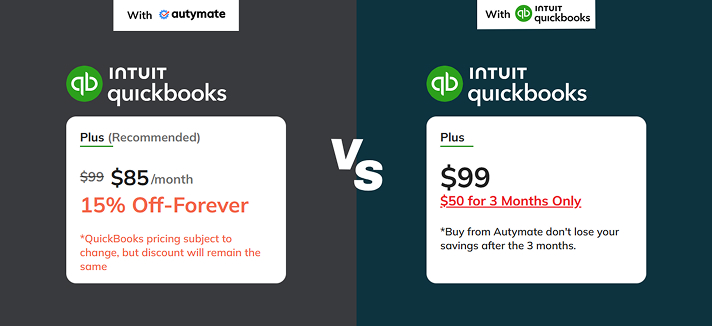

Why Autymate Makes P&L Reporting Easier

Financial reporting can be stressful and time-consuming. With Autymate, business owners can automatically:

• Sync data with accounting software

• Reduce manual errors

• Access real-time financial dashboards

• Produce consistent, accurate reports

• Automate workflows that simplify transaction closing

Autymate gives business owners clear, accurate financial reports without the complexity of manual reporting.

Conclusion

Every business owner must understand and create a Profit and Loss (P&L) statement to see their company’s true financial performance. Autymate makes this process effortless by automating P&L generation and ensuring that data always stays accurate and up to date.

The Autymate platform integrates seamlessly with accounting software, allowing users to generate detailed P&L reports with just a few clicks. Using the dashboard, business owners can monitor trends, customize reports, and automate much of the financial reporting process.

If you want to simplify your financial management and elevate your reporting accuracy, . Our platform provides the insight, automation, and support your business needs to achieve financial clarity and long-term success. Start Working With Me Now

Let Autymate help you achieve financial success!

.png)

.png)