Back To All Blogs

Balance Sheet Reconciliation: A Complete Guide for Accurate Financials

Accurate financial reporting is the backbone of every successful business enterprise. Of all the accounting activities, balance sheet reconciliation is one of the most important processes that ensures the reliability, integrity, and accuracy of financial statements. Poor reconciliation of balance sheet accounts can expose businesses to misstated financials, compliance issues, and poor decision-making.

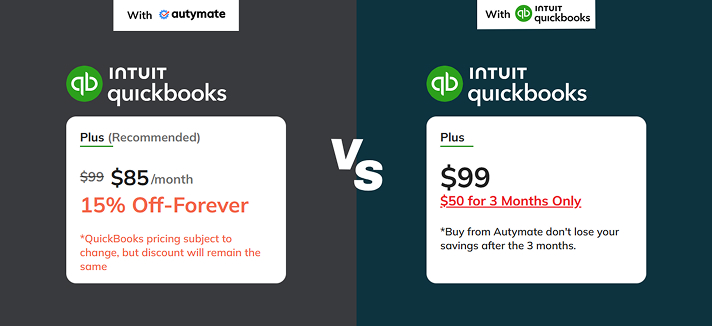

As an organization grows and the number of transactions within the company increases, manual reconciliation becomes time-consuming and prone to errors. This is why modern businesses are increasingly adopting automated solutions like Autymate to ensure seamless balance sheet reconciliations and maintain financial accuracy at scale.

This blog describes why balance sheet reconciliation is a key process in preparing financial statements. It provides details about the reconciliation process, some issues in the process of balance sheet reconciliation, and ways to improve the process. In addition to this, some tools and techniques are discussed in this blog, and one such tool involves using Autymate to improve balance sheet reconciliation, making them important for scaling business.

What is Balance Sheet Reconciliation?

Balance sheet reconciliation is the process of ensuring that the figures reflected in balance sheet accounts are correct according to the underlying records. This process verifies that all balances are accurate and supported by evidence.

It involves lining up and comparing:

- General Ledger Balances

- Sub-ledgers

- Bank Statements

- Supporting Schedules

- External Confirmations

If any discrepancies arise, they need to be tested and corrected.

Why is Balance Sheet Reconciliation Important?

The balance sheet represents a company’s financial position at a given time. Errors in these statements can lead to significant repercussions. Below are some key reasons why reconciliation is crucial:

- Accuracy: Confirms the correctness of financial statements.

- Fraud Prevention: Helps identify mistakes, gaps, or fraudulent activities.

- Audit Readiness: Ensures compliance with regulations and prepares for audits.

- Improved Decision Making: Promotes confidence in reported figures and fosters strong internal controls.

Unless properly reconciled, even the most well-prepared profit-and-loss statement may be misleading.

Common Balance Sheet Accounts That Require Reconciliation

Most balance sheet accounts require regular reconciliation, including:

- Cash and Bank Accounts

- Accounts Receivable

- Accounts Payable

- Inventory

- Prepaid Expenses

- Accrued Expenses

- Fixed Assets

- Loans and Liabilities

- Intercompany Accounts

Each account has its own nature and level of risk, requiring a tailored approach to reconciliation.

Overview of the Balance Sheet Reconciliation Process

A structured reconciliation process is essential for consistency and accuracy. Here’s an overview of the steps involved:

Step 1: Accounts to Be Reconciled

- Finance teams design a reconciliation schedule outlining which accounts to reconcile, the frequency (monthly, quarterly, annually), and ownership and responsibility.

- High-risk accounts are reconciled more often.

Step 2: Collect Supporting Documentation

- This documentation includes:

- Bank Statements

- Invoices and Contracts

- Subledger Reports

- Inventory Records

- Loan Schedules

- These documents act as evidence for account balances.

Step 3: Comparing Balances

- The general ledger balance is compared against supporting records. Any differences are flagged for further investigation.

Step 4: Investigate and Resolve Differences

- Differences may arise from:

- Timing Differences

- Data Entry Errors

- Missing Transactions

- Incorrect Classifications

- Finance teams should identify the root cause and make the necessary corrections.

Step 5: Review and Approval

- Completed reconciliations should be reviewed and approved by a designated person to ensure accuracy and compliance.

Step 6: Documentation and Audit Trail

- All reconciliations must be documented and stored with a proper audit trail for future reference and auditing purposes.

Challenges with Manual Balance Sheet Reconciliation

While reconciliation sounds straightforward in theory, manually performing the process presents several challenges:

- Time-Consuming Spreadsheets

- Lack of Standardization

- Human Errors and Inconsistencies

- Limited Visibility into Reconciliation Status

- Difficulty Managing Multi-Entity or Multi-Location Accounts

- Weak Audit Trails

As transaction volumes grow, these challenges intensify.

Why Automation Is Essential for Balance Sheet Reconciliation

Automation transforms reconciliation from a reactive, manual task into an efficient, controlled process. The benefits include:

- Faster Reconciliation Cycles

- Reduced Errors

- Standardized Workflows

- Real-Time Visibility

- Stronger Internal Controls

- Improved Audit Readiness

Modern organizations cannot scale reconciliation effectively without automation.

Guidelines for Accurately Reconciling a Balance Sheet

Here are some best practices to maintain accurate financials:

- Standardize Reconciliation Templates

- Consistent formats reduce errors and improve clarity.

- Assign Clear Ownership

- Ensure each account has a designated owner and reviewer.

- Reconcile Regularly

- Frequent reconciliations prevent small issues from escalating.

- Utilize Automation Tools

- Automation decreases human effort and enhances reliability.

- Maintain Strong Audit Trails

- Proper documentation supports compliance and auditing.

How Autymate Improves Balance Sheet Reconciliation

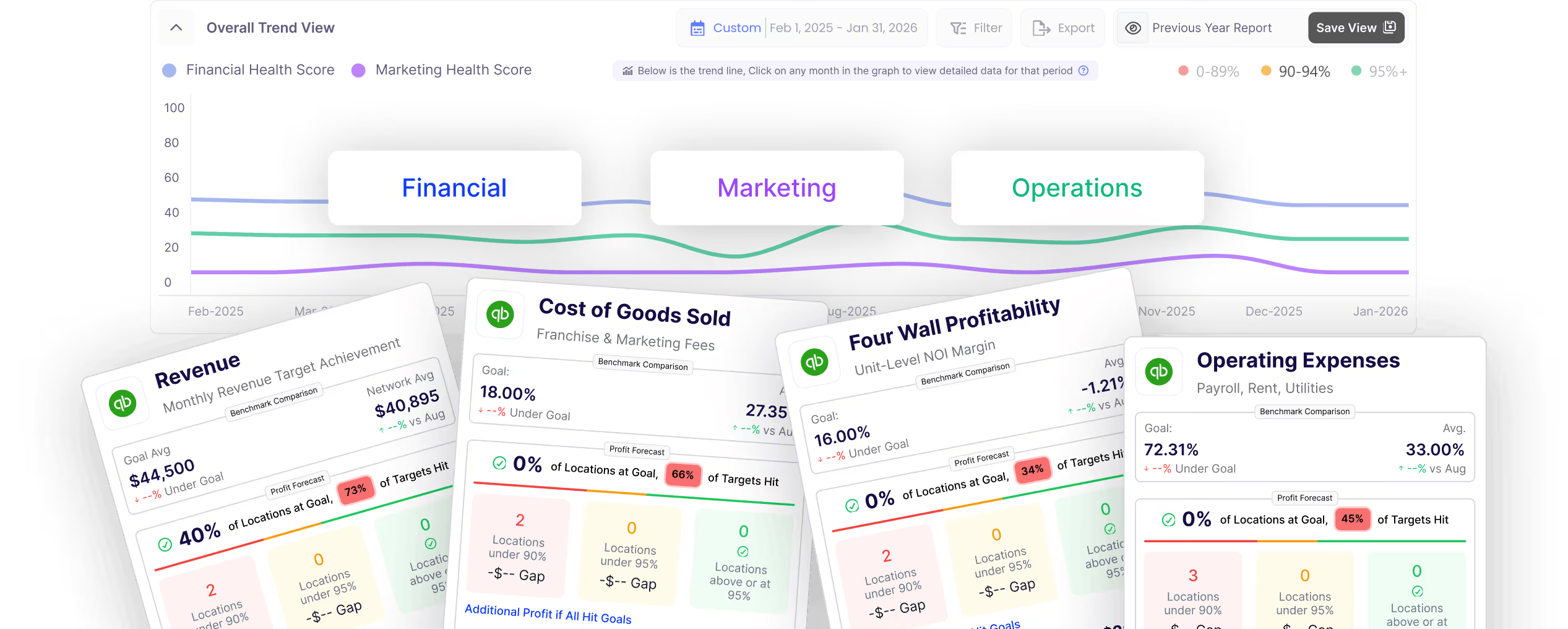

Autymate provides a comprehensive solution for automating and standardizing balance sheet reconciliations, offering enhanced visibility, efficiency, and governance over financial close activities.

Centralized Reconciliation Management

- Autymate allows finance teams to handle all reconciliations from one platform, eliminating dispersed spreadsheets and ensuring smooth coordination.

- Benefits include:

- Single Source of Truth

- Clearly Assigned Tasks

- Better Control Over Tight Timelines

Automated Reconciliation Workflows

- Key steps like data collection, matching balances, workflow routing, and exception tracking are automated, reducing manual workload and minimizing errors.

Real-Time Status Updates/Tracking

- Finance leaders can easily track:

- Completed Reconciliations

- Pending or Overdue Items

- Bottlenecks

- This enhances close management and transparency.

Standardized Templates & Controls

- Autymate enforces standardized reconciliation templates and approval processes to ensure consistency across accounts and entities, while strengthening internal controls and reducing compliance risks.

Multi-Entity & Shared Services Support

- Autymate facilitates reconciliation for organizations with multiple entities or shared service centers, allowing for:

- Entity-level reconciliations

- Centralized Supervision

- Consolidated Reporting

Audit-Ready Documentation

- Autymate automatically stores all reconciliation details, including supporting documents, review/approval history, and changes, which streamlines the auditing process.

Balance Sheet Reconciliation and the Financial Close

Balance sheet reconciliation plays a crucial role in month-end and year-end close processes. Delays or errors directly affect reporting timelines. Autymate speeds up the close by:

- Reducing manual steps

- Providing increased visibility into progress

- Ensuring accuracy before reporting

This enables finance teams to produce financial statements more quickly and confidently.

Who Benefits from Automated Balance Sheet Reconciliation?

Autymate’s reconciliation capabilities are ideal for:

- Growing Businesses

- Accounting and Finance Teams

- Finance Shared Services

- Multi-Entity Organizations

- Audit-Related Industries

Automating reconciliation leads to more accurate financials and streamlined close processes, benefiting organizations of all sizes.

The Future of Balance Sheet Reconciliation

The future of reconciliation is:

- Automated

- Real-Time

- Standardized

- Integrated with Financial Close

Businesses that continue relying on spreadsheets will struggle to keep up with the growing demands for compliance and scalability.

Final Thoughts

Balance sheet reconciliation is critical for financial statement preparation, internal control effectiveness, and audit readiness. Manual reconciliation processes are ineffective for modern businesses that need to scale.

Automation improves accuracy, efficiency, and visibility, transforming reconciliation into a controlled, scalable process. Autymate helps organizations modernize their reconciliation processes, offering real-time data and automated workflows. With reduced risks and enhanced efficiency, finance teams can close and report with confidence.

{{blog-final-cta}}

Ready to Find Your

Profit Leaks?